Overview of Fenwick & West Results

While the first half of 2013 saw a surge in initial public offerings (IPOs) by venture-backed biopharma companies, the overall financing environment for privately held life science companies remains slow.

The average valuation increase for life science companies receiving venture capital financing during the first half of 2013 was roughly even with 2012 results, and the percentage of “up round” financings declined slightly. Fundraising by life science venture capitalists continued to decline as well.

Key observations and highlights include the following:

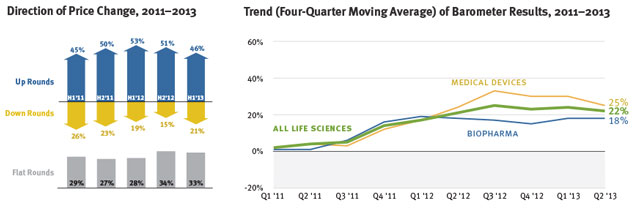

- Up rounds outpaced down rounds 46% to 21% during the first half of 2013, representing a modest decline from 2012 results.

- The average round-to-round price increase for companies receiving venture financing, as measured by the Fenwick & West Life Science Venture Capital Barometer™, was 25% in Q1 of 2013 and 15% during Q2, bringing the four-quarter moving average to 22%. For comparison, average Barometer results for 2012 were 23%.

- Investments in venture-backed life science companies (as reported by VentureSource and the MoneyTree Report) remain on par with 2012 levels. Total dollar investment during the first half of 2013 was in line with

five-year historical averages, but the number of deals was down by more than 10%. - Fundraising by life science venture capitalists continued to decline during the first half of 2013. Our analysis indicates that the percentage of VC fundraising allocable to life sciences has declined from 27% of funds raised in 2008 to 11% of funds raised in the first half of 2013. In absolute dollar terms, we estimate that fundraising has fallen from an average of $7.8 billion/year in 2007 and 2008 to $1.3 billion in the first half of 2013 (representing an annualized rate of $2.6 billion/year).

- Life science M&A activity during the first half of 2013 was slower in comparison to results reported for the same period in 2012.

- The life science IPO market was exceptionally strong during the first half of 2013. A total of 15 U.S.-based venture-backed life science companies (14 in the biopharma sector) went public during the period, raising a total of $1.1 billion. Public market stock indexes for life science companies also significantly outpaced broader market averages.

- With regard to venture financing deal terms, senior and participating liquidation preferences remained a relatively common feature of life science venture financings during the first half of 2013, appearing in 45% (for senior preferences) and 56% (for participating preferences) of the financings we reviewed. This is in line with results observed during 2012, although the percentage of deals with participating liquidation preferences has declined modestly.

- Pay-to-play provisions are also a common feature of life science venture financings, appearing in 26% of financings during the first half of 2013, in comparison to an average of 21% of 2012 financings. A substantial majority of these pay-to-play provisions apply only to additional closings of the current financing round, indicating that they were implemented in connection with tranched or milestone-based financing structures.