No matter who is doing the counting, 2018 was an off-the-charts year for venture investment in digital health. Here’s a sampling of the tallies:

- Our good friends at Rock Health put the total investment at $8.1 billion – an impressive 42 percent increase over 2017’s total of $5.7 billion.

- The PwC/CB Insights MoneyTree Report posted an even higher total of $8.6 billion up from $7.1 posted in 2017.

- StartUp Health reported $14.6 billion in global investment in digital health, up nearly 150 percent from 2017’s total of $6 billion (cited by MobiHealthNews).

And it’s not only that more money is going into the sector, it’s going into larger deals. Rock Health reports that the average deal size has grown to $21.9 million. That’s up from $15.9 million in 2017 and $13.6 million in 2016.

The Rise of the Megadeal

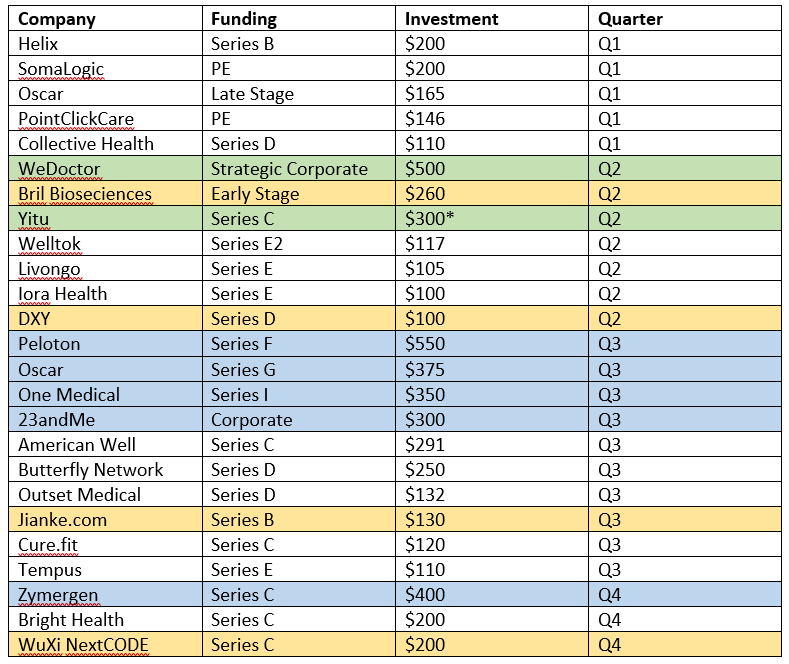

Over the course of 2018 we have tracked the rise of the digital health megadeal—investment rounds of more than $100 million. In the first quarter there were seven megadeals and seven more in the second quarter.

In the third quarter, the number of megadeals jumped to 11, five of those garnering $300 million or more, which we for purposes of comparison in our posts call “super-megadeals.” And in the fourth quarter, which is typically the slowest time of the year, three companies announced megadeals, bringing the total for the year to 25. Of those, seven were of the super-megadeal variety.

Blue: Super-megadeal

Yellow: China-based deal

Green: Both of the above

*YituTechnology got another round of $100M Series C funding in Q3 2018.

China Rising

Another trend we noted in 2018 was the emergence of China as a big digital health player. Halfway through the year, we noted that more than half of the megadeals for the second quarter went to companies based in China.

StartUp Health also noted the rise of Chinese digital health companies in their year-end report as reported by MobiHealthNews. The company reported that outside of the U.S., London and Beijing were tied for first place when it came to the number of deals, with 21 each. But Beijing companies took in a total of $950 million, more than four times the amount that London companies received ($198 million).

StartUp Health went on to report that Beijing wasn’t the only Chinese market to receive significant digital health investments. Shanghai had $125 million in investment; Hangzhou took in $105 million; and digital health companies in Zhenjiang received $100 million.

Originally published February 11, 2019 on Fenwick's Life Sciences Legal Insights blog.