Mountain View, CA (May 9, 2016) – Fenwick & West LLP, one of the nation’s premier law firms providing comprehensive legal services to high technology and life sciences clients, today announced the results of its First Quarter 2016 Silicon Valley Venture Capital Survey.

The survey analyzed the valuations and terms of venture financings for 148 technology and life sciences companies headquartered in the Silicon Valley that raised capital in the first quarter of 2016.

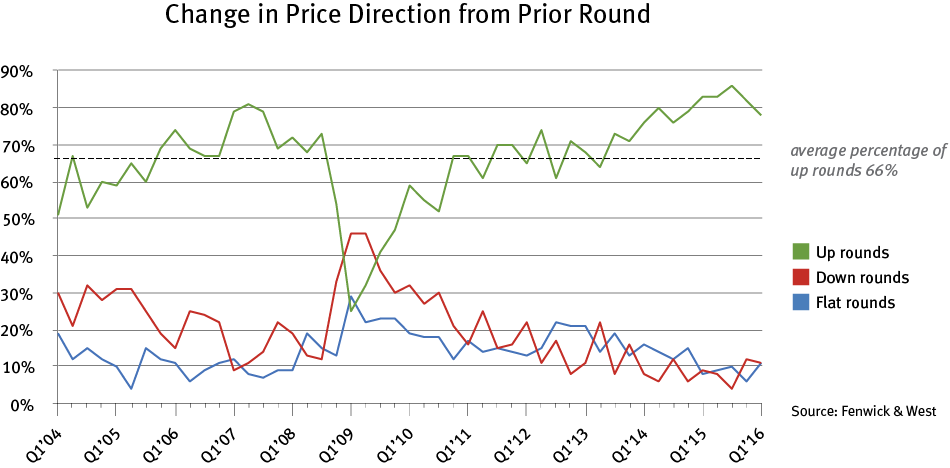

“During the first quarter of 2016, up rounds exceeded down rounds 78% to 11%, with 11% flat. This was a slight decrease from the fourth quarter of 2015 when up rounds exceeded down rounds 82% to 12%, with 6% flat," said Barry Kramer, partner in the Corporate Group of Fenwick & West and author of the survey.

An up round is one in which the price per share at which a company sells its stock has increased since its prior financing round. Conversely, a down round is one in which the price per share has declined since a company’s prior financing round.

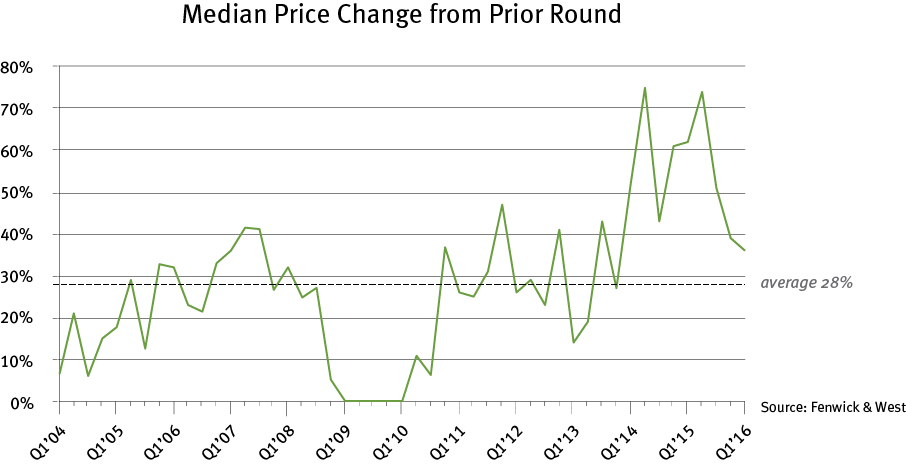

The average percentage change in the share price of companies funded during the quarter, compared with the share price of their previous financing round, showed a 53% price increase for the quarter, a decline from the 70% recorded in the fourth quarter of 2015 and the lowest amount since the first quarter of 2012. The median price increase of financings in the first quarter was 36%, a decline from the 39% recorded in the fourth quarter and the lowest amount since the fourth quarter of 2013.

The results for price change direction, average price change and median price change since the survey began calculating such statistics in 2004, are set forth below.

“This was the second quarter in a row of declines in the venture valuation metrics, and while such metrics are still mostly above our historical averages, another quarter of weakening would likely put the results below historical averages,” noted Kramer.

Complete results of the survey with related discussion are posted on Fenwick & West’s website at www.fenwick.com/vcsurvey.

About the Survey

The Fenwick & West Quarterly Venture Capital Survey, authored by law firm partner Barry J. Kramer, has been published for over 14 years and offers a unique view of the venture capital market in Silicon Valley by providing insight into the changes in venture capital valuations and terms. Focusing on trends in venture financing and valuations, the Fenwick & West Survey complements the economic data presented by Dow Jones VentureSource, the MoneyTree™ Report by PricewaterhouseCoopers and the National Venture Capital Association based on data from Thomson Reuters, and CB Insights.

About Fenwick & West

Fenwick & West provides comprehensive legal services to ground-breaking technology and life sciences companies – at every stage of their lifecycle – and the investors that partner with them. We craft innovative, cost-effective and practical solutions on issues ranging from venture capital, public offerings, joint ventures, M&A and strategic relationships, to intellectual property, litigation and dispute resolution, taxation, antitrust, and employment and labor law. For more than four decades, Fenwick has helped some of the world’s most recognized companies become and remain market leaders. For more information, please visit fenwick.com.